membership

Push & Pool

What’s causing supply chain disruptions – and how to secure the products you need at a reasonable price

Pool industry experts and supply chain leaders help you understand why materials and finished goods are so hard to come by now and share tips for proactive success

© Korisbo | 3D Rendering of Modern Cozy House with Pool | stock.adobe.com

© Korisbo | 3D Rendering of Modern Cozy House with Pool | stock.adobe.com

It’s bad enough as a consumer that you can’t find the products you want at your local superstore. As a business owner or management leader, understanding your supply chain and then getting ahead of shipping delays and canceled orders has been a nightmare—and an expensive one at that.

“It’s been a real challenge,” says Chris Curcio, owner of Litehouse Pools & Spas, a multi-service retail chain.

We sought out experts to help you take back control of your supply chain.

What’s causing our supply chain crisis?

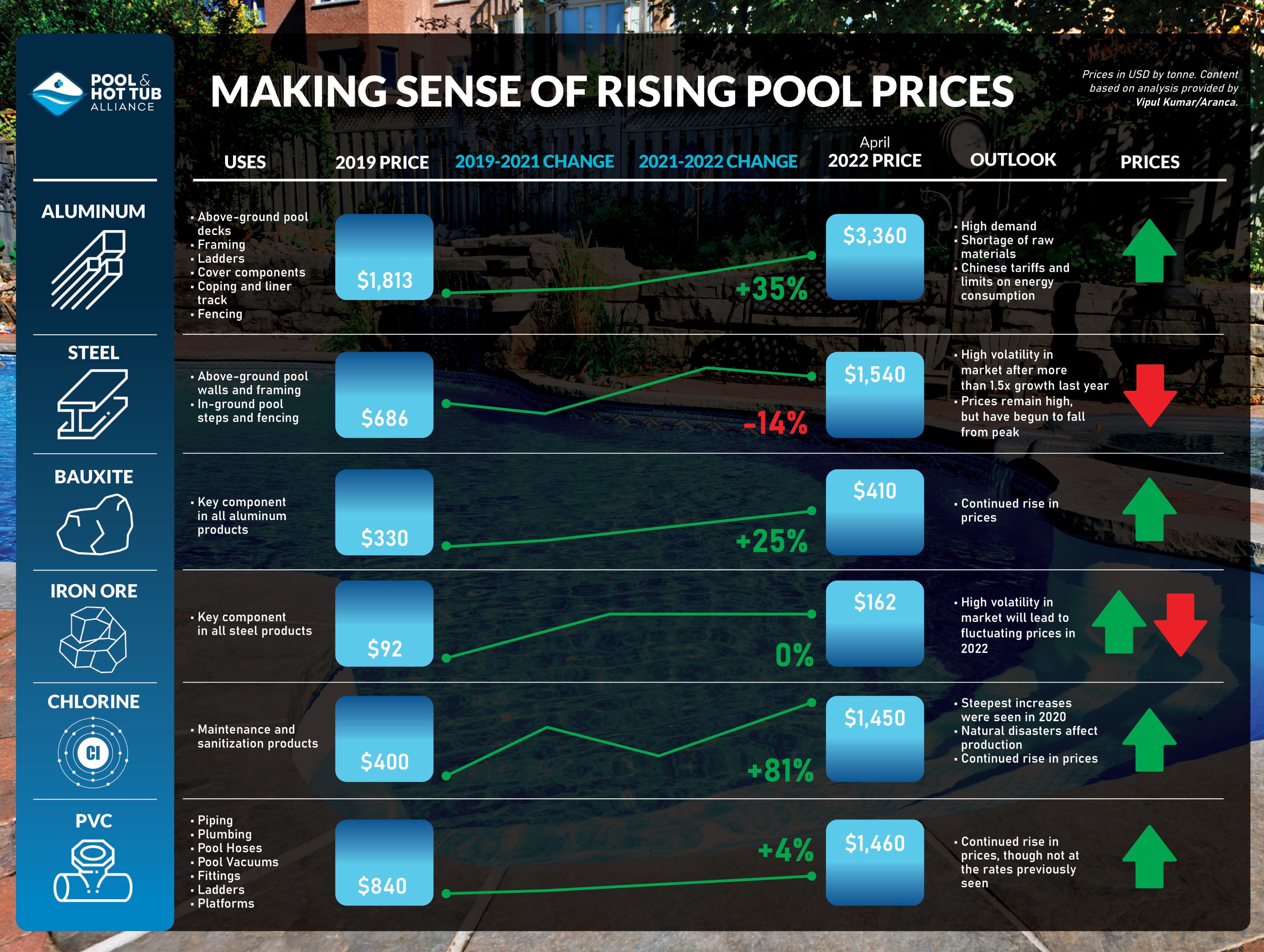

What started with the pandemic is now a much more complicated issue, explains Vipul Kumar, senior manager of procurement research at global advisory firm Aranca. The materials used widely in the pool industry saw 100% growth in prices in the last couple of years, but the causes of each category’s meteoric rise vary, Kumar says. Causes include:

Weather – Hurricanes and the Texas winter storm affected local and regional sourcing for key materials at the same time demand was blowing up for pool repairs and replacements.

Labor – The inability to hire enough labor to meet demand and the increase in wages has led to an uncertain balance between having enough supply and having enough affordable supply.

Geopolitical issues – As companies look to alternative suppliers in the wake of shortages they’re met with tough decisions about where to source.

Where will we continue to see issues?

Consider that the booming demand for pools, hot tubs, and related products and services hasn’t died down since the pandemic’s start, meaning if you were behind on sourcing before, other disruptions compounded your woes.

Products and components coming from overseas

Scott Frost, executive vice president of sales & marketing for Fluidra North America, said they used data and predictive analysis early in the pandemic to determine they should stockpile.

Fluidra, the global pool equipment company, benefits from having “nearshore” supply chains, which made supplies more accessible when logistics networks became unreliable. Robert Handfield, Ph.D., supply chain professor at North Carolina State University, applauds the move.

“[Mexico has] got lower labor costs than China and has since 2014, and they are a truck drive away,” Handfield says. If you can find out from your vendors and partners where they’re sourcing the things you buy, you’ll be better prepared to build relationships with those nearby.

Certain raw materials

Some key product inputs you need are especially affected, including chlorine, PVC pipe, and aluminum and steel framing. Kumar says that local value chains for those raw materials that only come from one place in the world, will be the hardest to correct for in 2022. The good news? Our supply base is intact, he says, and capacity is returning to normal.

Click image to enlarge

“Nothing is going to change in the short term. But prices won’t go up 50-100% like we saw in 2020 and 2021. It will be more like 10-15%, and if we’re talking about logistics, we expect those networks to stabilize.”

What can I do to get products I need at a reasonable price?

Collectively our experts have offered four options for how you can meet customer demand with the least amount of impact from the current record price increases caused by inflation.

#1. Hold off on buying

Aranca’s Kumar points to forecasts that show that by Fall 2022, “prices will be more manageable” and supplies will be more accessible.

“Many companies really stopped procuring this year,” he says. “They expect things to go down by end of the year and they’re waiting for next year.”

Kumar advises business owners to do their research and dig into where 80% of their procurement spend is going and then get to know the tiers of that particular supply chain. You may find you can wait on just a few products to have the biggest savings.

#2. Buy in bulk together

While small contractors and retailers can’t negotiate the most advantageous bulk agreements, they can use industry associations like the Pool & Hot Tub Alliance to find the right partners.

“Bulk buying [is achievable if] you understand the industry by connecting with industry associations and get to know larger organizations that can support you and that you can buy from. That way you don’t have to stop buying,” he says.

#3. Pass price increases and supply chain improvement costs on to consumers

This tip comes with a caveat. Aranca’s research shows that cost overruns in the industry are being passed to customers in the range of 30-50% but, from Kumar’s standpoint, “that’s not sustainable. At the end of the day customers know, and it has to stop.” He says use this tactic sparingly.

Frost cites the need for price clauses and flex clauses in contracts, especially for pool builders. Gone are the days of the easy quote. Flat-rate projects are now subject to the mercy of wide fluctuations.

“That’s a mistake in today’s world,” says Frost, who serves on the PHTA Board of Directors. “That builder is getting squeezed if they don’t have flexibility in their contract.”

#4. Forecast when you’ll need supplies, then partner with your distributors to be ready

Frost suggests that builders, service companies, and retailers partner with distributors. It used to be that distributors didn’t need to have inventory to deliver product quickly; the pandemic changed that. Use whatever data and analytics your business collects to forecast demand—and then share that information with your distributor partner so they can plan their purchases from the manufacturers.

“[Before the pandemic] a pool professional would call on the phone and say, ‘Hey, I need some steel, and I need a pump’ and it showed up in a day or two,” Frost recalls of the old way. “COVID demand spike showed us that that was not a sustainable business model.”

Whether you’re in the pool industry on the retail, building, service, or manufacturing side, nothing has been easy. In some ways you have to become your own expert to succeed.

“At the [lower tiers] of the supply chain, initially, there was no visibility whether supplies were coming or not. But now companies have started looking at it,” Aranca analyst Kumar says. “They never before thought they had to understand what was happening behind the scenes, but they now see how it impacts them.”

Regardless of what’s coming in the future, PHTA will continue to partner with our members to help you weather any storm or disruptions that may come our way.