membership

Raising Up the Next Generation: Lessons on Family Succession Planning

Three family-owned pool businesses share their preparations for a successful passing of the torch

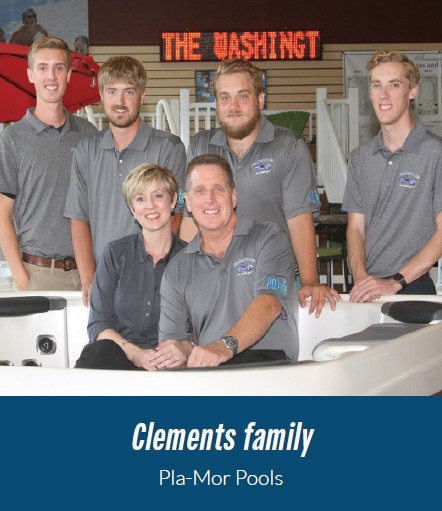

For Jennifer Clements, planning for the future of family-owned retail business Pla-Mor Pools is personal.

For more than 40 years, Jennifer and her husband Kenny have been running their Virginia-based business that was originally founded by Kenny’s parents in 1968. Jennifer and Kenny’s four sons have literally grown up in the store that served as their second home, while interacting with staff that served more as family than employees, says Jennifer.

Shortly after the boys began working at Pla-Mor as teenagers, Jennifer started seeing the potential benefits of having the sons forge careers in the business. Jennifer and Kenny have been working towards that goal ever since by sending their kids to training, discussing it frequently with the kids, and — more recently — meeting with financial and tax consultants, now that Kenny is 65.

“We reached a point where we couldn’t just talk about it anymore,” said Jennifer. “We’ve had friends who have lost spouses. It’s at that point where we just started making appointments and saying it’s time to get the ball rolling.”

Succession planning takes a lot of preparation and work, especially when family is involved. Here’s how three successful family pool businesses are making it happen.

Start them young

Bob Blanda, founder and CEO of Brooklyn, NY’s Mill Bergen Pools, has been bringing his three children to the office and job sites since they were around ten years old. Exposing the kids to the business when they were young gave them the opportunity to both learn about the business and whether this was a career path they were interested in pursuing.

“We’re pool people, and we want to integrate the family into it right from the beginning, so they have that same love and passion for the industry,” he said. “But either you like it or you don’t. I’ll hand you the opportunity, and you have to earn it from there.”

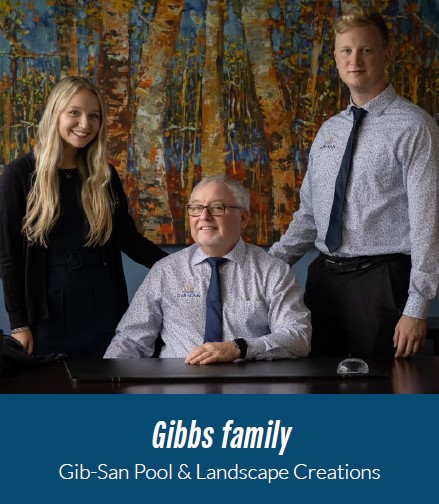

Like Bob’s children and Jennifer’s children, Connor Gibbs grew up through his family’s business, Gib-San Pool & Landscape Creations, located in Toronto, Canada. He plans to one day become a third-generation owner of Gib-San alongside his sister Caley.

Connor, who is now vice president and design consultant at Gib-San, said starting at the company at a young age can help people learn if they like the business, as well as earn the respect of their fellow employees as they progress in responsibilities. Equally important to his early start was the freedom he and his sister had to make their own paths in the business.

“It’s going to be based on interest and what you choose to chase down,” said Connor. “I’m given the autonomy to start digging into things, and if I’m interested in it, it’s up to me to follow through.”

Prepare, train, and test

There are many ways to prepare your kids to take on the family business. For Bob, training looked like immersing his children Alexa and Robert in various areas of Mill Bergen Pools operations, six months at a time.

“I’m constantly trying to train them in different phases of business development,” said Bob.

Today, Alexa handles all of Mill Bergen Pools’ bills, invoicing, and office needs, but Bob said that transition happened slowly. Her leadership role has freed Bob to focus exclusively on sales and work from home, which makes him feel “a little retired.”

Though he plans to continue working and creating growth opportunities for Mill Bergen Pools for many years, he wants his children to be prepared to take over at any moment “in case something happens."

At Pla-Mor, Jennifer started preparing her sons to run the business more than 15 years ago. This preparation has paid off because her husband Kenny has started working only three days per week in 2024.

To best prepare for this transition, Ben has been learning Kenny’s role in the business and currently leads the service department as well as Pla-Mor’s renovation projects. At the same time, Jacob has been training to take over Jennifer’s duties involving business development.

Their eldest son Daniel leads Pla-Mor’s international purchasing while managing one of their retail stores. Youngest son Josiah handles scheduling and is a key member of the service department.

Jacob says all his brothers’ career paths are unique and driven through self-motivation.

“I’ve been on a furious journey of learning,” said Jacob. “Anything I can learn about the industry, about successfully managing a business, being a better leader – I’m doing everything I can do to build the knowledge base I need.”

Parents can also prepare their children for leadership roles by letting them “practice” during slow seasons. Jennifer and Kenny have spent the past few winters in Florida and stayed connected in a virtual office with a voiceover IP phone while the boys took on additional responsibility back in Virginia.

“That distance through the winter has helped us to see what we need to fine tune, and then we’ve been back standing alongside them for the busy season and continuing to steer the ship,” said Jennifer.

"We’re pool people, and we want to integrate the family into it right from the beginning, so they have that same love and passion for the industry."

- Bob Blanda, Mill Bergen Pools

Plan for the transfer

When it comes to transferring business assets, your options will vary depending on your business structure and the laws of the country your firm operates in. Working with qualified accountants, lawyers, and financial advisors can help you understand the best approach for your business and family.

While Connor and Caley Gibbs will be buying Gib-San over time via a stock purchasing plan, Bob Blanda and Jennifer Clements are considering transferring their business assets via a trust.

“What we’re going to be doing is basically an installment sale over into a revocable trust, where our four boys are beneficiaries,” said Jennifer, who will be the trustee so she can help ensure distributions will be fair.

Because there are limits to how much stock can be transferred into a trust without incurring gift tax, Jennifer’s advice is to start talking to a tax advisor early.

“Even if it’s going to be 15 years down the road, don’t wait,” she said. “Tax law is always changing. It’s going to be an ongoing conversation, but at least understand what it might look like so you aren’t coming to the table too late.”

To Bob, planning how to divide your business ahead of time is key, but communicating it with your children in advance is paramount.

“It’s better if it’s laid out in a plan that everybody knows and can argue about now,” said Bob. “Besides that, you have to have a conversation to really see if they have passion, tools, and ability to take this business to the next level.”